The FV function is a default function of Microsoft Excel which is categorized as a financial function. It helps to figure out the future value of an investment. We can use this FV function for different conditions. It is used for periodic, constant payments or a single lump-sum payment. In this article we will discuss the use of the FV function in Excel will explanations and proper illustration.

What is the Future Value (FV)?

Future Value (FV) is the estimated value for a current investment based on an annual interest rate after a certain time. It is important for the people or investment organizations who plan to invest so that the investment will be worthy. This future value is estimated based on periodic, specified payments and a fixed interest rate.

For simple interest Future value will be:

And for compound interest

For both cases,

PV = It is the present value.

r = It is the rate of interest annually

t = It is time in years

n = It is the number of times interest applied per time period

Introduction to FV Function

Function Objective:

Calculates the future value of an investment.

Syntax:

=FV(rate,nper,pmt,[pv],[type])

Argument:

| ARGUMENTS | REQUIRED/OPTIONAL | EXPLANATION |

|---|---|---|

| rate | Required | It is the rate interest per period |

| nper | Required | The total number of payment periods in an annuity. |

| pmt | Required | The amount of payment in each period. This amount is fixed. It contains the principal amount and the interest. If pmt is omitted, pv must be included. |

| pv | Optional | It is the present value. Also indicated as the lump sum amount of a future payment. |

| type | Optional | This number is 0 or 1 and indicates when payments are due. 0 at the end of the period and 1 at the beginning of the period. |

Returns:

It returns a numeric value.

Available in:

Excel for Microsoft 365, Microsoft 365 for Mac, Excel for the web Excel 2021, Excel 2021 for Mac, Excel 2019, Excel 2019 for Mac, Excel 2016, Excel 2016 for Mac, Excel 2013, Excel 2010, Excel 2007, Excel for Mac 2011, Excel Starter 2010

How to Use the FV Function in Excel

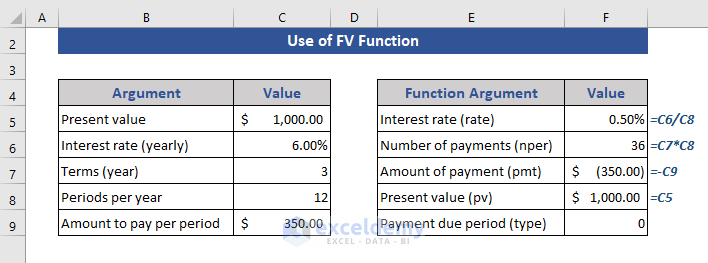

We will show how to use the FV function. We have 5 arguments in the FV function. Now, take sample data to show the process.

In the data set all the information are shown with details.

Step 1:

- Now, we will make another table to show you how we will use the data in the formula.

- We indicated the data as our formula argument requires.

We divided the interest rate by periods per year and multiplied terms and periods per year for consistent units.

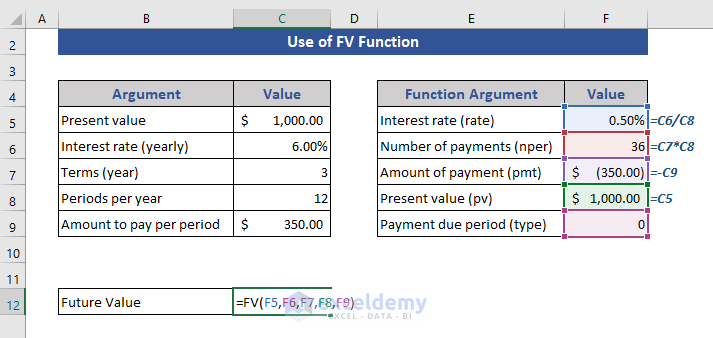

Step 2:

- Now, go to Cell C12 and write the FV function.

- Complete the formula by taking data from the newly created data table. Formula is:

=FV(F5,F6,F7,F8,F9)Step 3:

- Finally, press Enter.

Here, we get the future value finally. We showed how to process to data so that we can use them in the formula.

How to Use the Excel FV Function in Daily-life: 4 Examples

We are showing some examples of the use of the FV function.

1. Basic Use of Excel FV Function

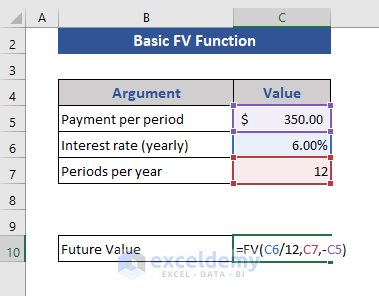

In this section, we will show the basic use of the FV function.

Step 1:

- We have simple data set containing periodic payments, interest rates, and periods.

Step 2:

- Go to Cell C10.

- The formula based on FV function is:

=FV(C6/12,C7,-C5)Step 3:

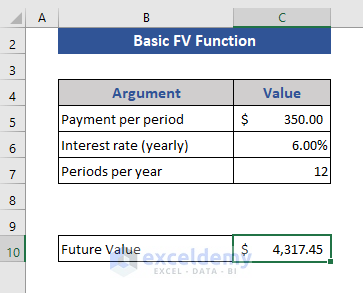

- Now, press Enter.

This is the future value get after applying the basic FV function. Here, we divided the interest rate by 12 as we will make 12 payments.

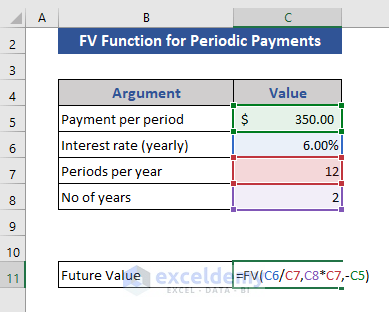

2. Use of FV Function for Periodic Payments

In this example, we will show the periodic payments using the FV function.

Step 1:

- We have taken the below data set for this example.

Step 2:

- Now, write the FV function.

- The complete formula is:

=FV(C6/C7,C8*C7,-C5)Step 3:

- Then press Enter.

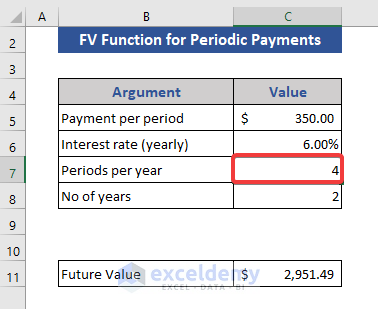

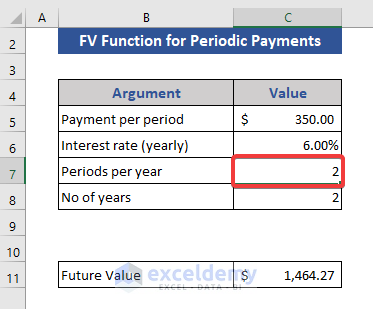

This is the future value after 2 years when somebody is making the monthly payment. The periodic payment can be changed to quarterly or half-yearly.

In the case of quarterly payment, the interest rate will be divided by 4, and no. of payments will be the multiplication of years and 4.

In the same when considering half-yearly payment, interest will be divided by 2, and no. of payments is years multiplied by 2.

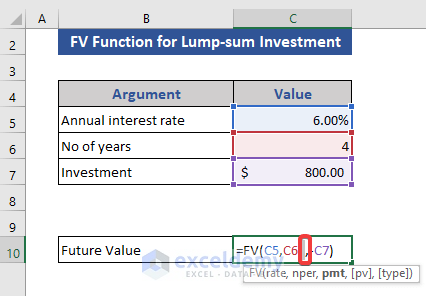

3. Use of FV Function for Lump-sum Investment

This example will show the future value of a lump-sum investment.

Step 1:

- The below data set is used for this example.

Step 2:

- Write the formula on Cell C10.

=FV(C5,C6, ,-C7)Here, we kept the pmt argument blank.

Step 3:

- Now, press Enter.

This future value is showing for a lump-sum amount after 4 years.

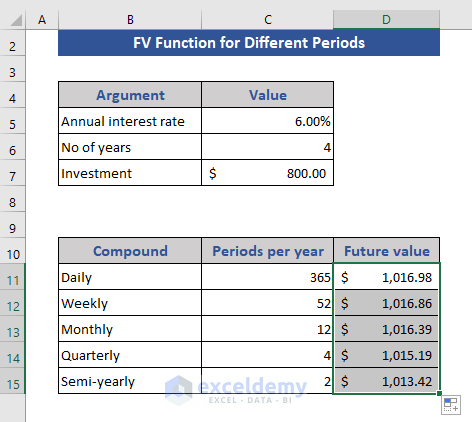

4. Future Value for Different Periods Using FV Function

This example will show that how different periods will affect the future value.

Step 1:

- In the data set, we have taken different periods.

Step 2:

- Go to Cell D11.

- Write the FV The formula is:

=FV($C$5/C11,$C$6*C11, ,-$C$7)Step 3:

- Then press Enter.

Step 4:

- Pull the Fill Handle icon to the last cell.

Here, we see the difference. As the periods change future value also changes within the same time range.

Things to Remember

- Amount of the Payment (pmt) and Present Value (pv) must be entered as a negative number.

- When any of the arguments are non-numeric shows #VALUE!.

- Make sure that you are consistent about the units you use for specifying rate and the Number of Payments (nper). If you make monthly payments on a four-year loan at 12 percent annual interest, use 12%/12 for rate and 4*12 for the Number of Payments (nper). If you make annual payments on the same loan, use 12% for the rate and 4 for the Number of Payments (nper).

- For all the arguments, when you pay cash is considered a deposit. This is represented by negative numbers. Otherhand, when you receive cash like dividends that are represented by positive numbers.

Download Practice Workbook

Download this practice workbook to exercise while you are reading this article.

Conclusion

In this article, we showed the use of the FV function in Excel. We also added examples to get a clear idea to use this function I hope this will satisfy your needs. Please give your suggestions in the comment box.

<< Go Back to Excel Functions | Learn Excel